Web Page UNDERWRITING Dashboard Analyzing Performance with $20,000

Desciption

$20,000

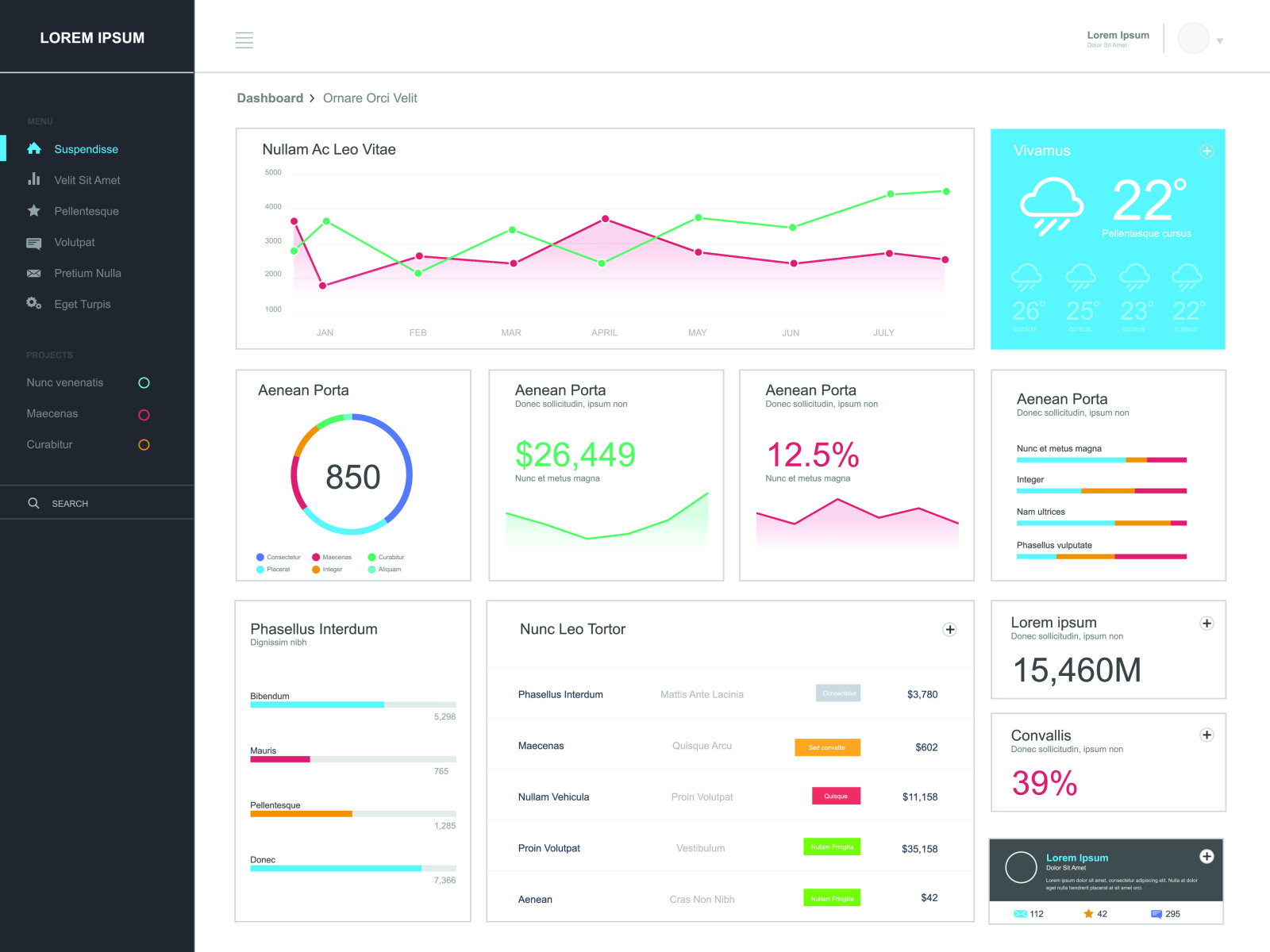

Dashboard Title: UNDERWRITING: How is Underwriting Performing?

Subtitle: Set your minimum loss ratio in the right hand corner and start selecting State/Tier combos to see how they affect the other graphs.

Overall Summary: This dashboard provides a comprehensive overview of the performance of an underwriting business. It allows users to set their minimum loss ratio and select different State/Tier combos to see how they affect the other graphs. It also provides insights into large paid losses by policy number, the book spread by deductible, and losses in excess of $50K.

Insights Gained:

Gain insights into the performance of an underwriting business

Set a minimum loss ratio and view the impact on other graphs

View large paid losses by policy number

See the book spread by deductible

View losses in excess of $50K

Who Can Benefit:

Underwriting businesses can benefit from this dashboard by gaining insights into their performance. It allows them to set their minimum loss ratio and view the impact on other graphs. It also provides insights into large paid losses by policy number, the book spread by deductible, and losses in excess of $50K.

Who Can Use:

Underwriting businesses, insurance companies, and other related organizations can use this dashboard to gain insights into their performance. It allows them to set their minimum loss ratio and view the impact on other graphs. It also provides insights into large paid losses by policy number, the book spread by deductible, and losses in excess of $50K.

Benefits:

Gain insights into the performance of an underwriting business

Set a minimum loss ratio and view the impact on other graphs

View large paid losses by policy number

See the book spread by deductible

View losses in excess of $50K

Data

UNDERWRITING: How is Underwriting Performing?

Note: Set your minimum loss ratio in the right hand corner and start selecting State/Tier combos to see how they affect the other graphs.

What is our Loss Ratio by State and Tier?

1

10

20

30

40

CT

MA

NJ

NY

PN

9

1%

©2015 Dec

2%

1%

so

3%

2%

5%

2%

1%

0%

$200,000

2%

2%

8%

5%

2%

0%

1%

6%

3%

1%

$400,000

Loss Amount

0%

3%

2%

0%

50

1%

0%

What are our Large Paid Losses by Policy Number?

4992

21184

21667

14400

3637

28833

1056

24402

14640

2%

2%

2%

60

$600,000 so

0%

0%

1%

3%

0%

F

$1,000

70

0%

0%

1%

1%

1%

$2,000

80

6%

0%

2%

0%

0%

$3,000

Written Premium

90

0%

0%

3%

0%

3%

$4,000

100

0%

0%

5%

0%

1%

$5,000

How is our book spread by Deductible?

Earned Premium

$250

Loss Amount

$500

$1,000

$2,500

$5,000

$7,500

$10,000

What are our Losses Excess of $50K?

$600K

$400K

$200K

Set your minimum loss ratio: 30%

SOK

$0

$5,000

$10,000

Eamed Premium

$15,000