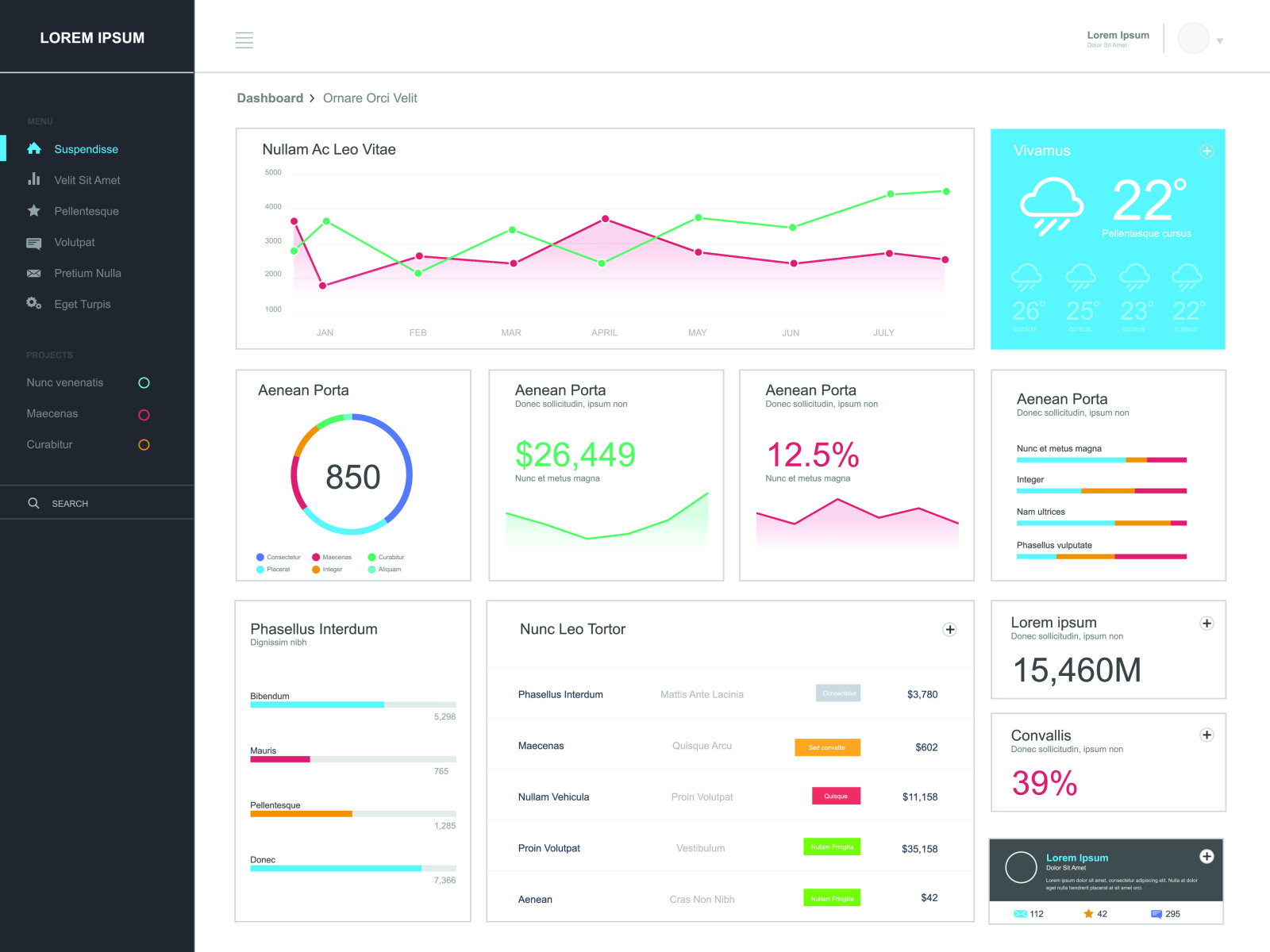

Dashboard Investment Performance

Desciption

This dashboard provides an overview of the investment performance of a portfolio. It displays the performance of the aggregate portfolio and by holding levels, asset allocation exposures, aggregate dividend yield, expense ratio, and common investment-regions. It also allows users to compare the performance of different investments over a period of time.

Benefits:

-Gain insights into the performance of investments over time

-Understand asset allocation exposures

-Evaluate the dividend yield of investments

-Analyze the expense ratio of investments

-Compare the performance of different investments

Who Can Benefit:

-Investment Managers

-Financial Advisors

-Individual Investors

Benefits for Investment Managers:

-Gain insights into portfolio performance

-Understand asset allocation exposures

-Evaluate dividend yield

-Analyze expense ratio

-Compare performance of investments

Benefits for Financial Advisors:

-Gain insights into portfolio performance

-Understand asset allocation exposures

-Evaluate dividend yield

-Analyze expense ratio

-Compare performance of investments

Benefits for Individual Investors:

-Gain insights into portfolio performance

-Understand asset allocation exposures

-Evaluate dividend yield

-Analyze expense ratio

-Compare performance of investments

Data

Portfolio Value

Lovelytics

America

Asia

Europe

$9.11M 0.67%

EMEA

15%

Investment Performance

10%

Expense Ratio

Investment Performance

The Investment Performance dashboard displays the performance from the aggregate portfolio and by holding levels. The

dashboard also shows the asset allocation exposures, aggregate dividend yield, expense ratio, and common investment-

Regions

70%

Dividend Yield

3.5%

Equity

Fixed Income

Private Equity

Annuites

Return

-31.2%

Allocations

15%

10%

10%

$10M

$SM

SOM

Investment Comparison

60%

1/12/22 1/27/22

Information

Technology

Materials

Industrials

Energy

Net Worth

Consumer

2/11/22

Sectors

2/26/22

10%

15%

15%

3/13/22

25%

POF